The Data Dive

AI Dominance in VC, Secondary Markets, Open Source Competition, Wealth Patterns, Nuclear Renaissance, Semiconductor Giants, and Other Economic Indicators

Authors Note: This newsletter was curated by me, but put together by my new friend Claude using

s Peekaboo MCP agent and @OpenAIs GPT 4o. Starting a new newsletter soon Agnes AI - where I document my quest for productivity playing with AI.________________________________________

"The stock market is a device for transferring money from the impatient to the patient."

— Warren Buffett

________________________________________

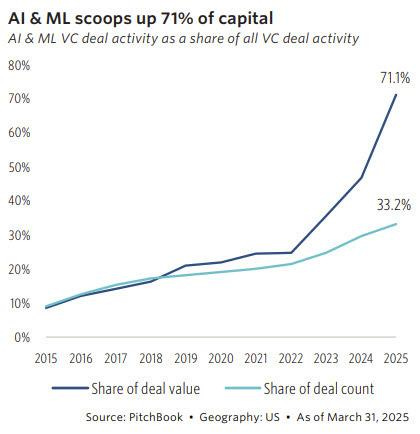

AI CAPITAL DOMINANCE

AI & ML ventures are capturing an unprecedented share of venture capital, reaching 71% of total deal value by 2025, demonstrating the market's massive shift toward artificial intelligence investments.

Via - PitchBook

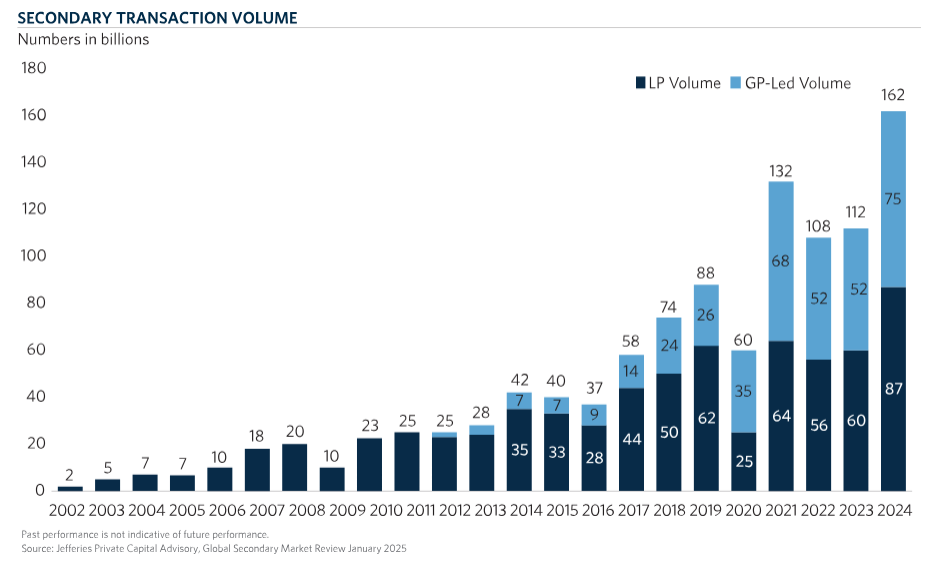

SECONDARY MARKET EVOLUTION

GP-led transactions becoming increasingly prominent reflecting longer hold periods and liquidity needs.

Via - Jefferies Private Capital Advisory

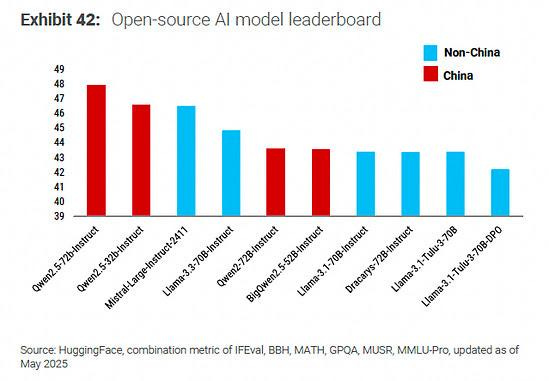

OPEN SOURCE AI LEADERSHIP

China-based AI models are increasingly competitive in the open-source landscape, with several models ranking highly on comprehensive benchmarks.

Via - Morgan Stanley

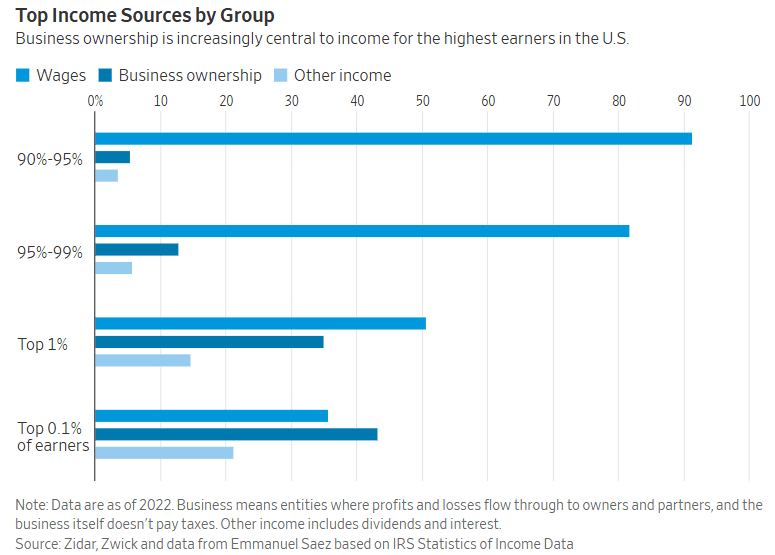

WEALTH CONCENTRATION PATTERNS

Business ownership is central to income generation for the highest earning percentiles in the United States, with the top 0.1% deriving most income from business rather than wages.

Via - Zidar, Zwick, Emmanuel Saez

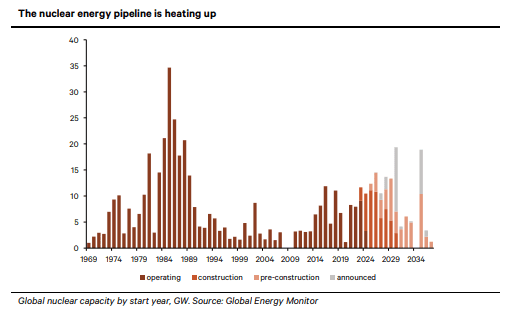

NUCLEAR RENAISSANCE

Global nuclear capacity pipeline shows significant expansion with projects in various stages from announced to construction, indicating renewed interest in nuclear energy as a clean power source.

Via - Global Energy Monitor

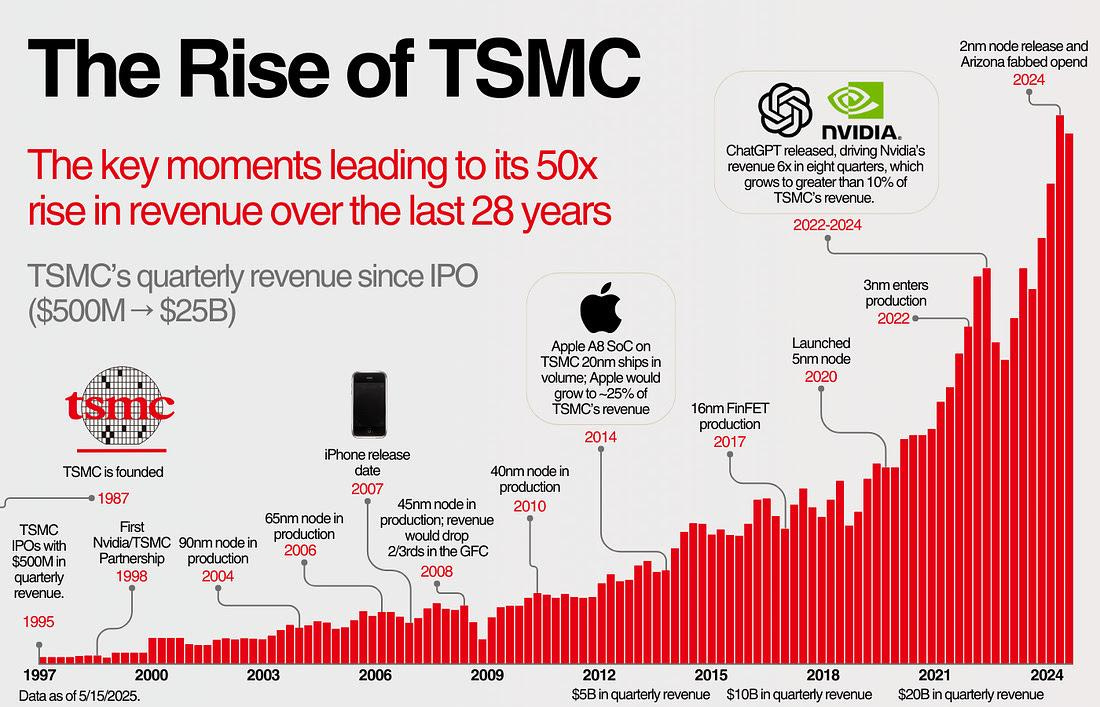

SEMICONDUCTOR TITANS

TSMC's remarkable growth trajectory over 28 years shows the semiconductor industry's evolution.

Via - Construction Physics

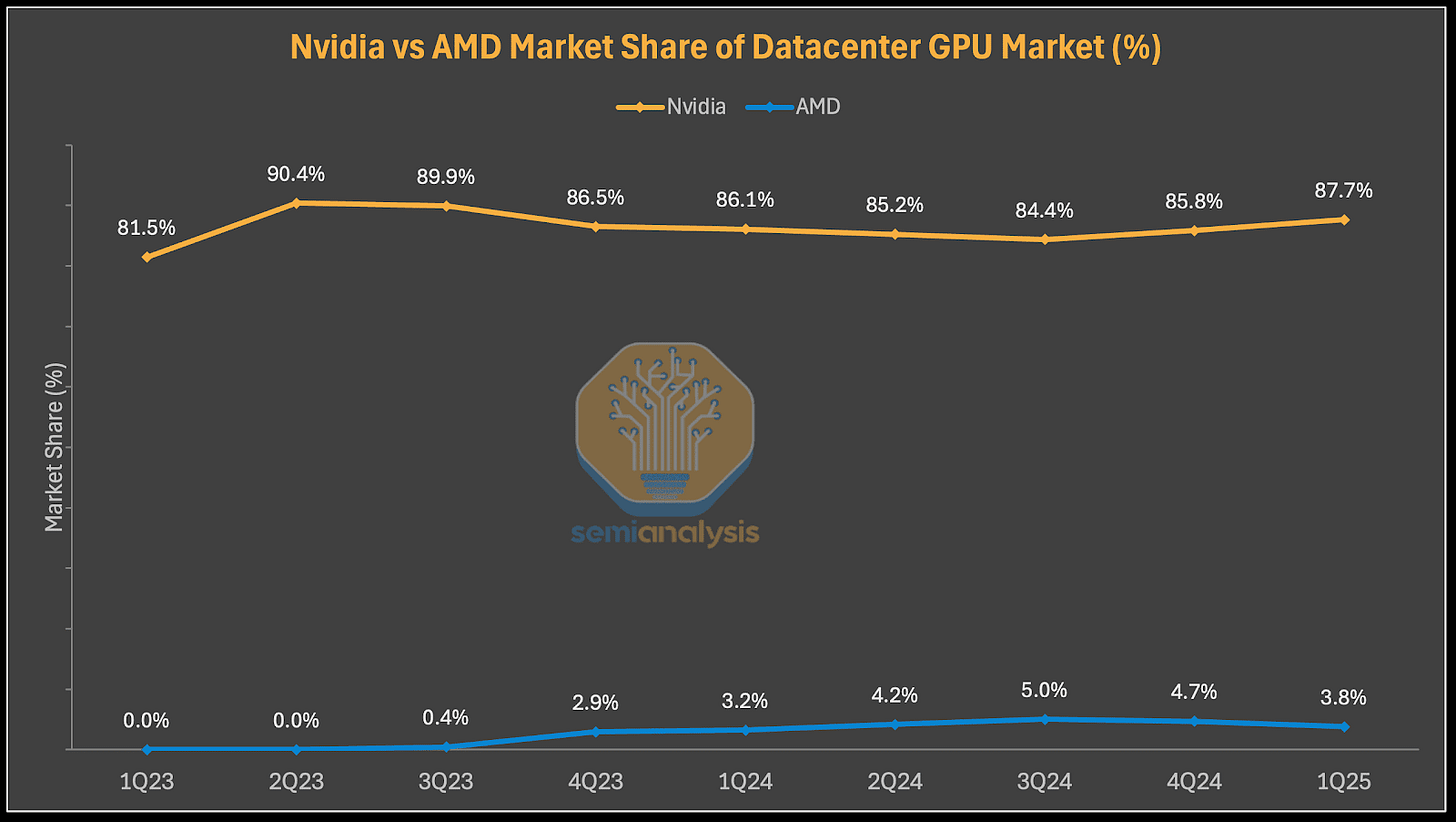

GPU MARKET DYNAMICS

Nvidia maintains dominant market share in the datacenter GPU market, with AMD holding a smaller but consistent position.

Via -

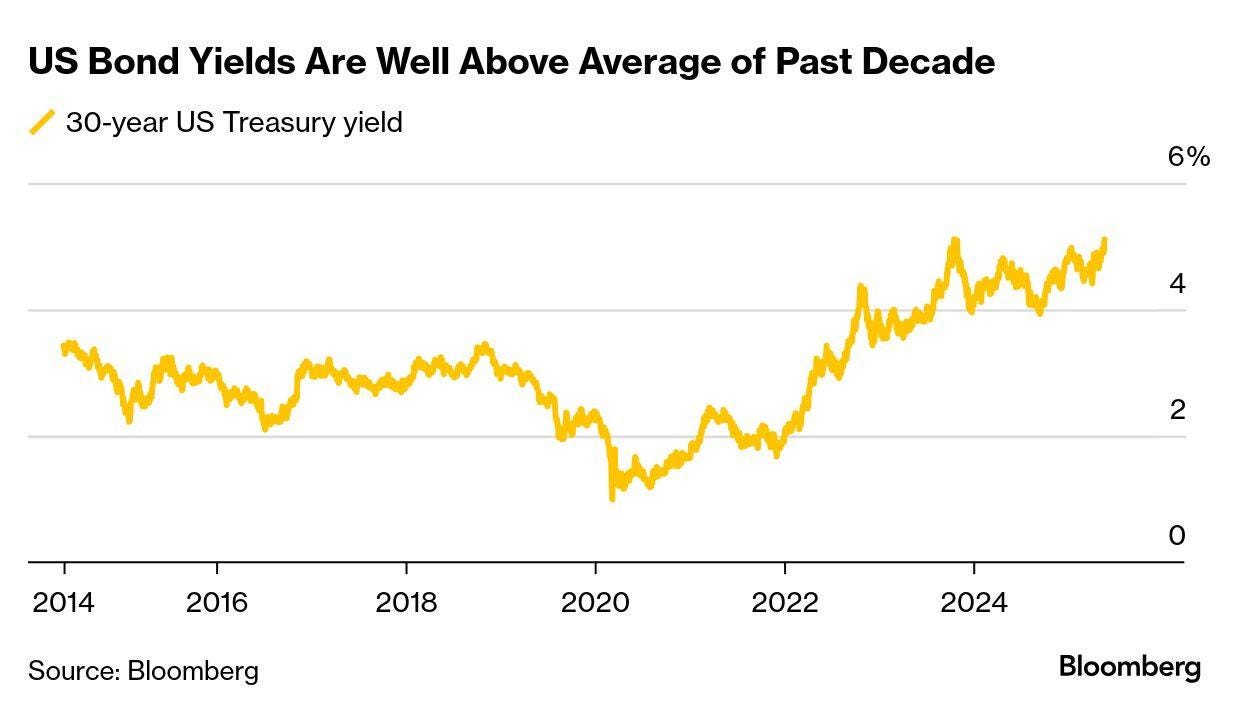

TREASURY YIELD TRENDS

US 30-year Treasury yields remain elevated compared to the previous decade's average, reflecting changing monetary conditions and inflationary pressure.

Via - Bloomberg

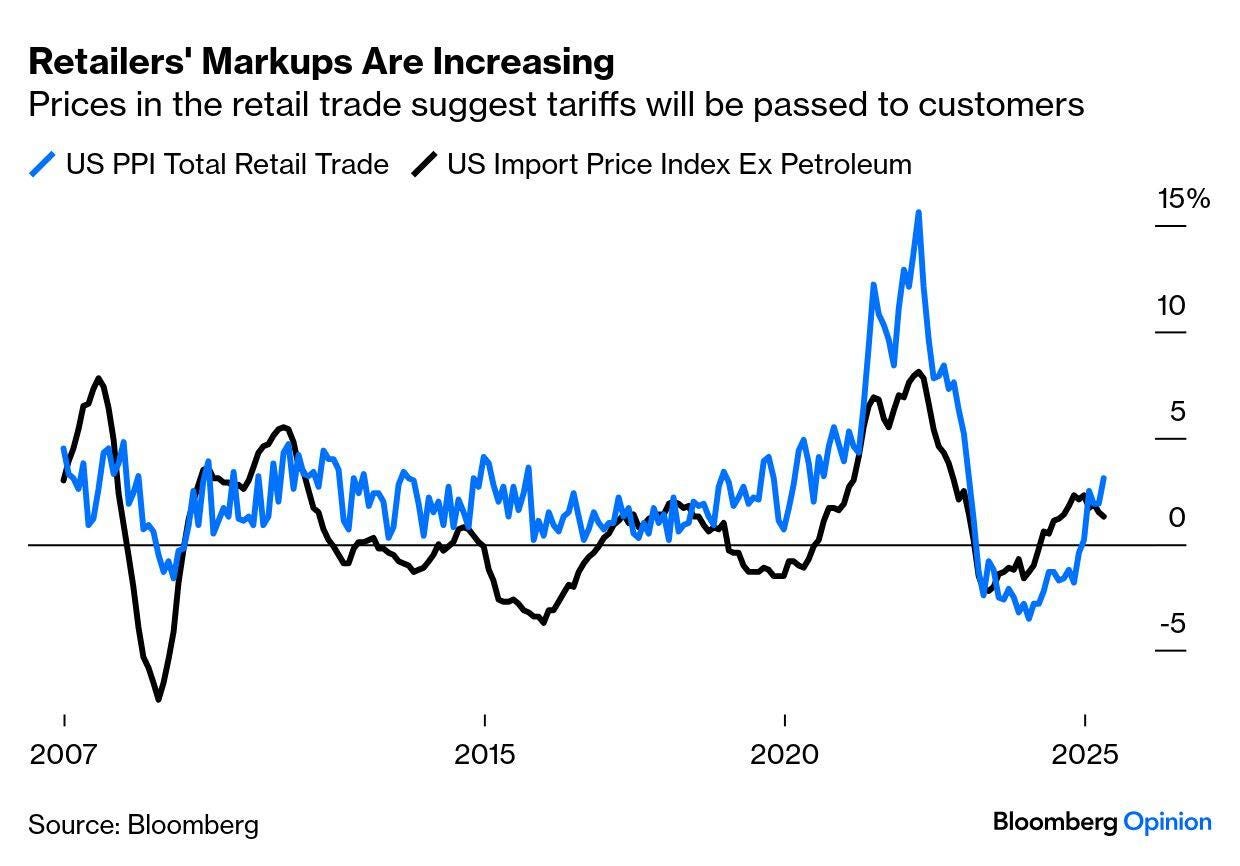

RETAIL MARKUP DYNAMICS

Retail markups are increasing as retailers pass tariff costs through to consumers, indicating how trade policy impacts pricing structures throughout the supply chain.

Via - Bloomberg