The Data Dive

Datacenter Construction, Popular AI Models, Small Caps, Ship Losses, SaaS Multiples, Bridge Funding, Fraud, Blockchain Scalability and VC Fund Decline

Knowledge is a process of piling up facts; wisdom lies in their simplification.

—Martin H. Fischer

AI

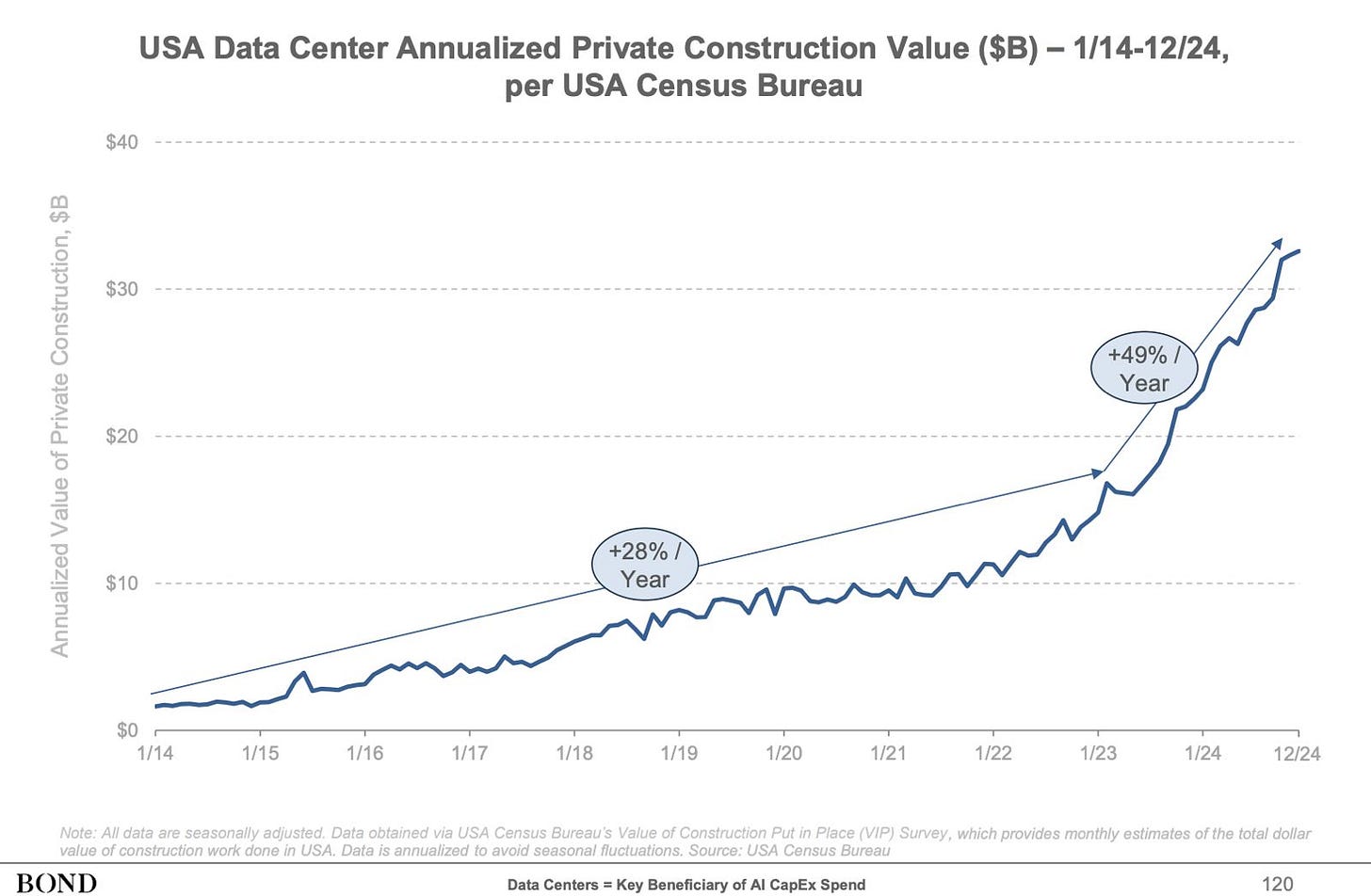

Private data center construction is booming.

Via - Mary Meekers Bond Cap Report

AI ADOPTION

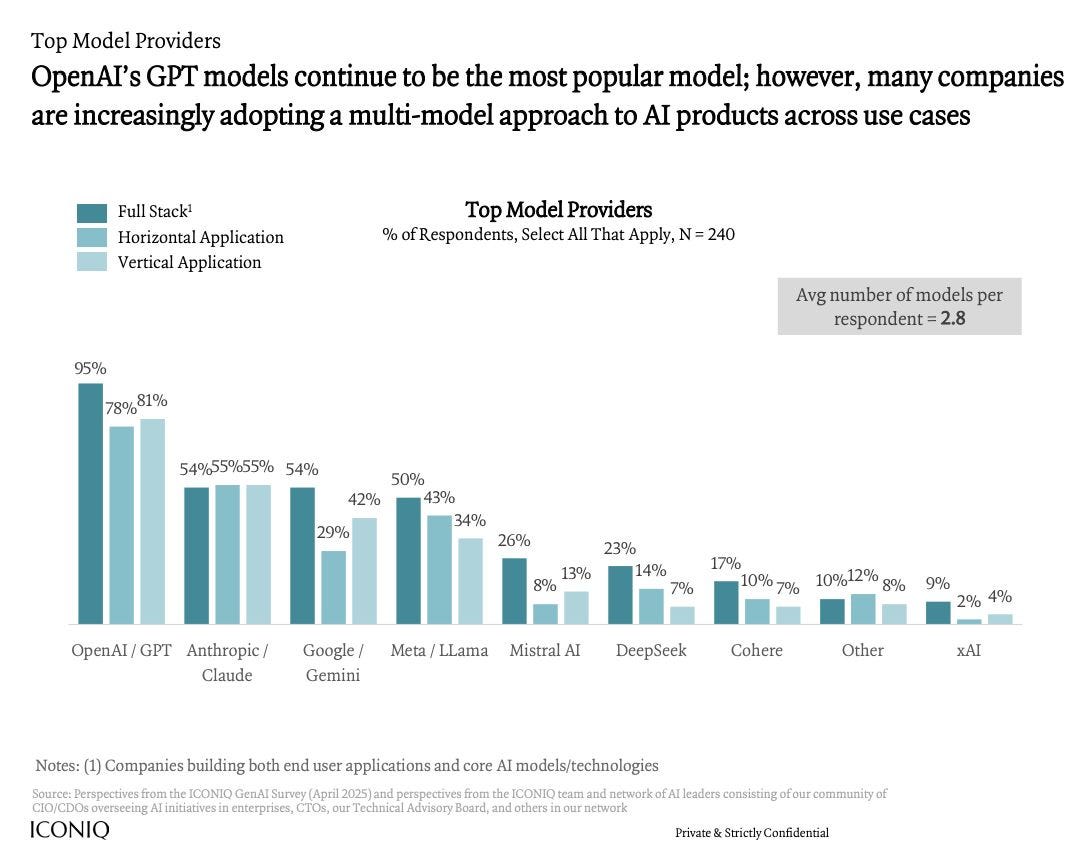

Companies adopt multiple AI model strategies.

Via – ICONIQ

VALUATION DIVERGENCE

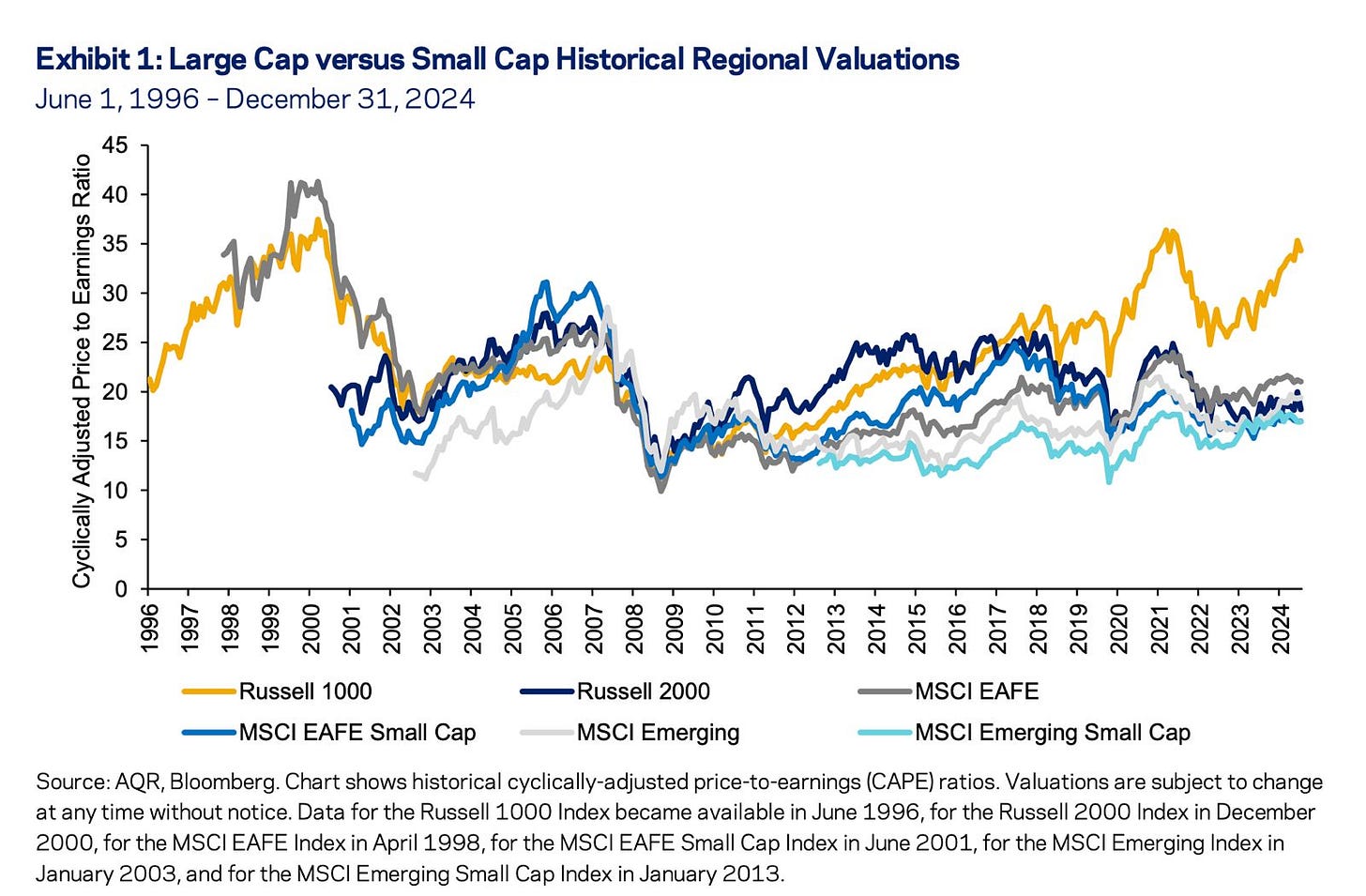

Small caps become more attractive.

Via – AQR

MARINE DANGER

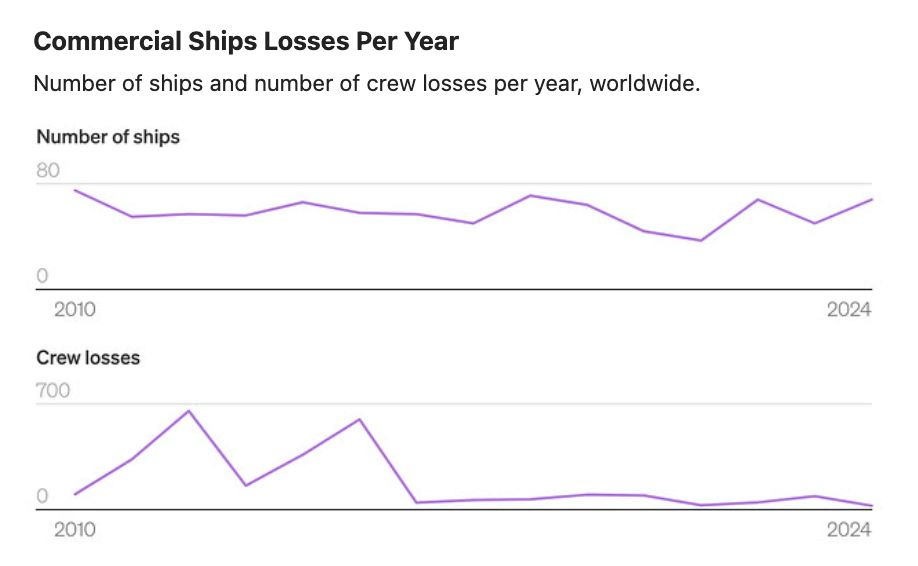

Ship and crew losses decline globally.

Via - EMSA

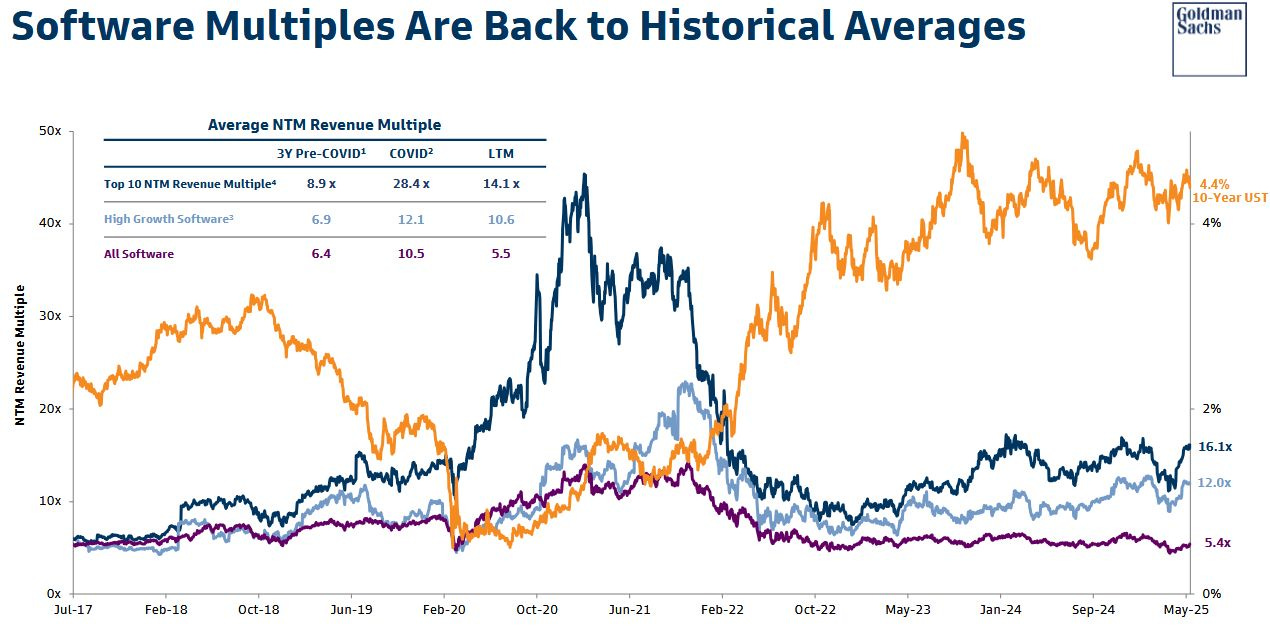

VALUATIONS BOUNCE BACK

Software multiples return to historical norms.

Via – Goldman Sachs

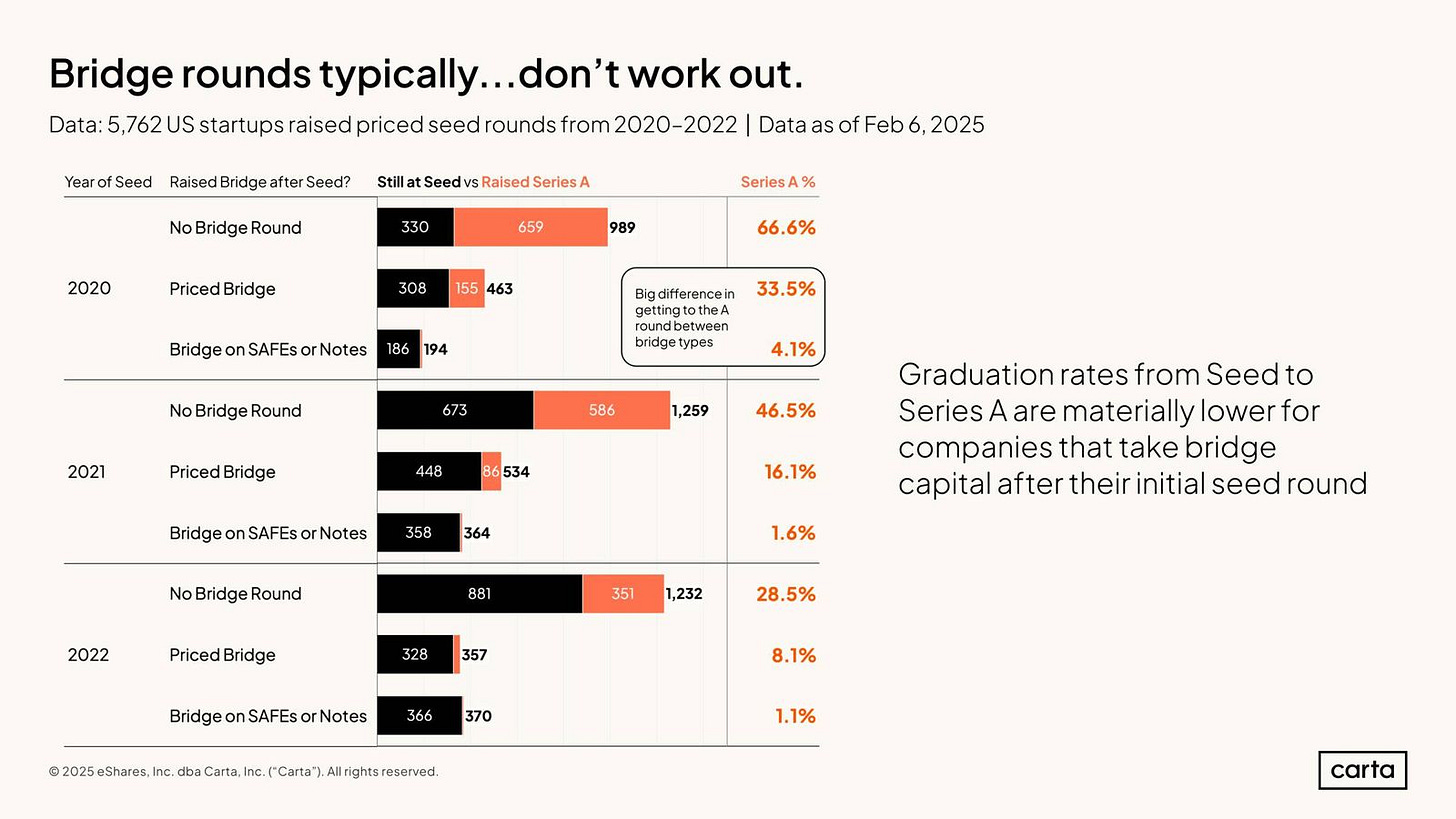

BRIDGE FINANCING

Seed startups raising bridge rounds rarely scale.

Via - Carta

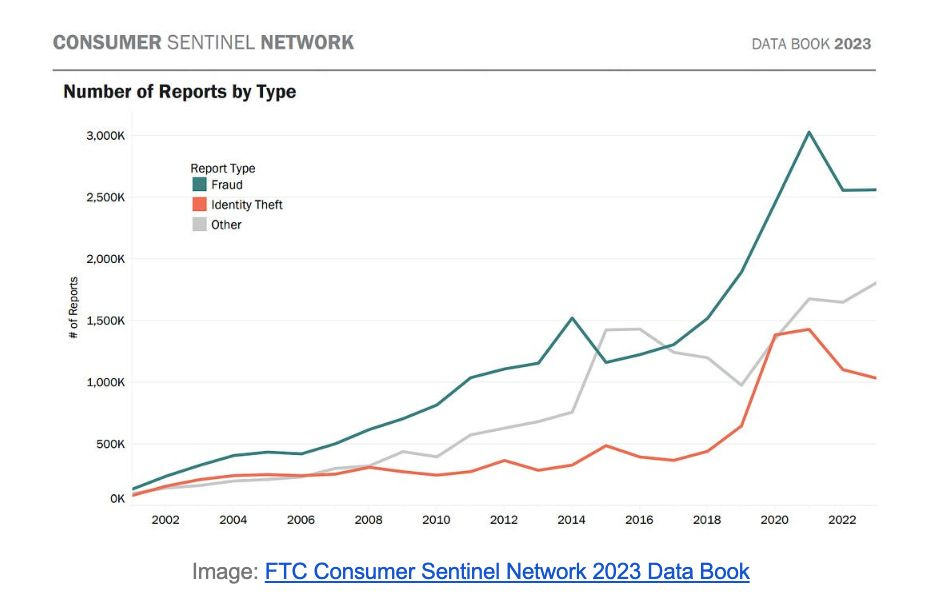

FRAUD TRENDS

Consumer fraud reports have risen since 2002.

Via - FTC

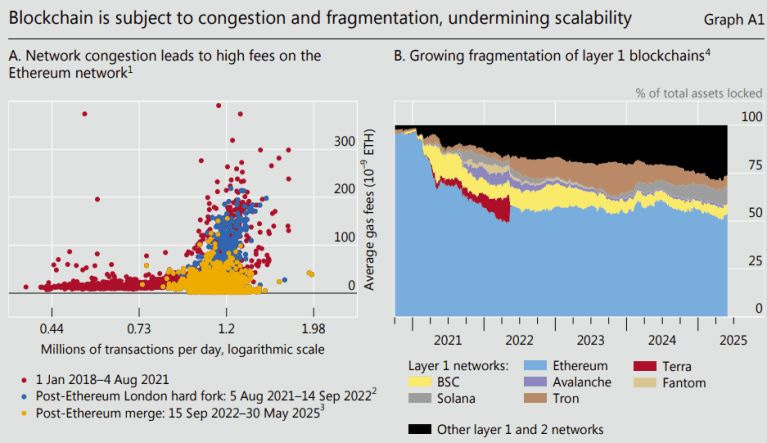

SCALABILITY ISSUES?

Blockchain congestion and fragmentation hinder growth according to BIS.

Via – BIS

FEWER VC FIRMS

Number of active venture firms drop sharply.

Via – FT

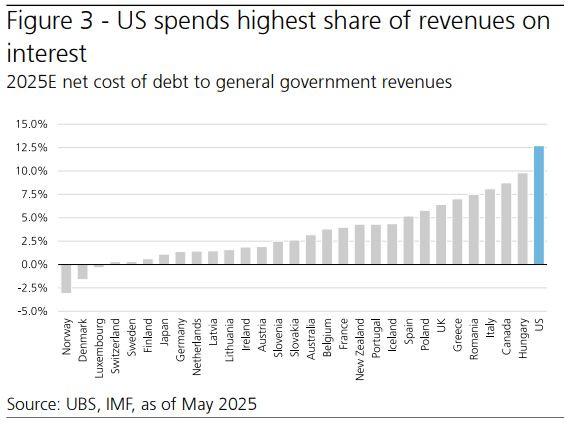

DEBT DRAG

US leads in Interest-to-Revenue burden among OECD.

Via - UBS

On the VC one - I would say we are seeing less generalist funds (Unless they are mega funds) and more specialized fund; i.e. More technical GPs tackling specific niches. That way, they can give more tailored support.

So, 2 types of funds: Mega generalist funds and specialized boutique VCs. No small sector agnostic fund in a few years.